PRO LAND INVESTMENTS

Passive Real Estate Fund Secured By Physical Land Assets With Cashflows

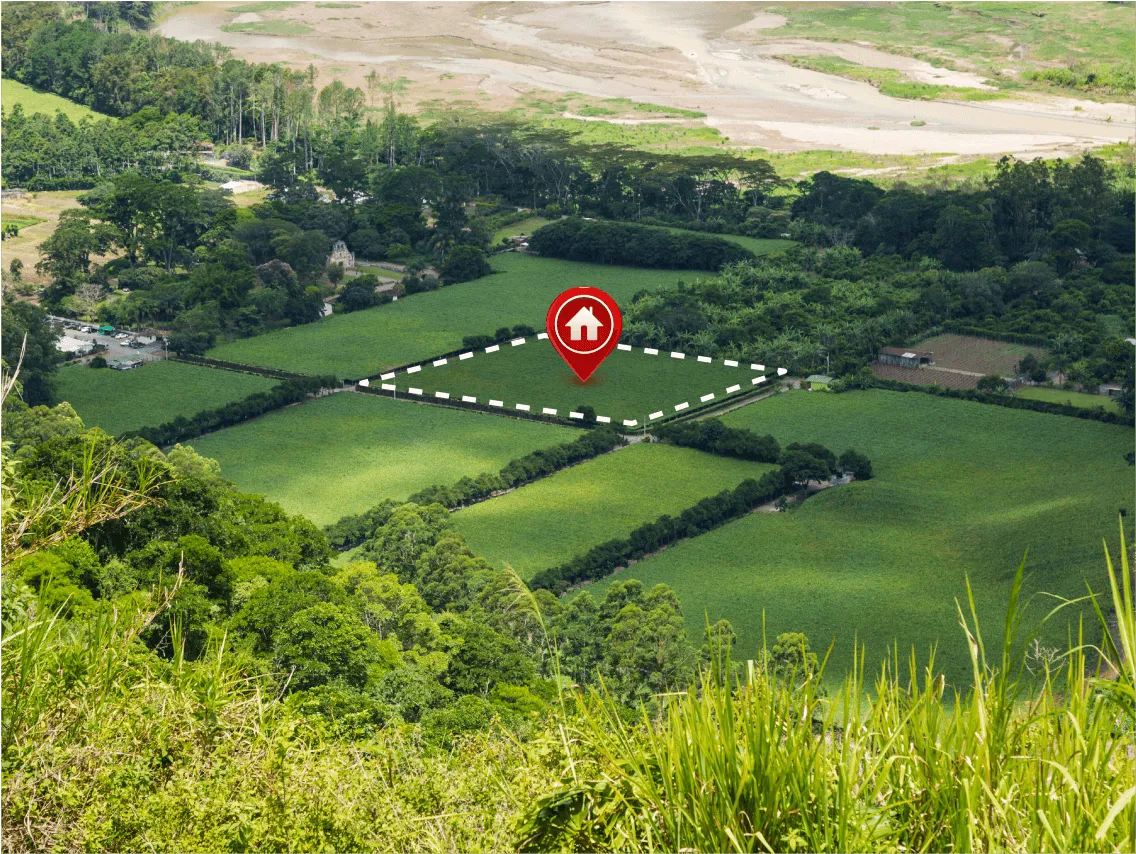

Our fund is backed by tangible land assets, offering investors a resilient and diversified portfolio anchored in physical real estate.

Funding Intro Chat

Connect 1-on-1 with our team to align your goals with our investment strategy.

What is ProLand?

We curated a Platform for our investors to earn a minimum of 11% p.a. returns through unique, fully passive, regulated investments with a low-risk profile all 100% backed by collateral.

What we Offer?

Assured diversification

High returns potential

Low minimum investment

Our Focus

Curated Opportunities

Unique investment opportunities qualified through rigorous internal due diligence

Transparency Focused

In-depth information for each opportunity’s investment highlights and risks, commercial terms, returns, and borrower’s profile

Data & Technology Driven

Data-driven decision making and utilization of latest technology to provide a seamless investor experience

Fund at a Glance

We're a real estate debt fund, financing investors buying vacant land in prime U.S. markets, with funding up to 70% of the market value.

Market Presence

New Carolina

Florida

Tennessee

Nevada

New Mexico

Alabama

Arizona

Oklahoma

California

Colorado

South Carolina

Utah

Texax

Georgia

Purchase discounted private notes

Pass interest payments to investors

Make an exit from selling notes for profit.

Higher Yields

Better Returns, Less Volatility

Well-Diversified

Land financing portfolio

100% Secured

By land collateral

Why Vacant Land?

Simplicity

Without the hassles of tenants, cracked foundations, leaking roofs or blown water heaters, vacant land offers one of the most straightforward asset classes to evaluate and manage.

Strategic Land Note Acquisition

Notes are purchased at up to 70% of land market value, minimizing initial investment risk.

Profitable Land Sales

Land is sold to an interested buyer at a markup of approximately 80% of market value, securing profit.

Secure Financing Structure

Fund provides financing to land buyers, holding deed/title as collateral in case of default.

Stable Cash Flow Generation

Quarterly payments from buyers ensure stable cash flow for investors.

Inflation-Beating Investment Opportunity

Our fund aims to offer investors a chance to beat inflation with returns generated from real estate.

How to Invest in ProLand?

STEP 01

Explore curated investment opportunities on our portal

Unique opportunities qualified through rigorous due diligence

STEP 02

Complete KYC and Investment Process

Seamless digital KYC, e-sign and payment experience

STEP 01

Receive returns as per pre-determined schedule

Receive quarterly returns directly In your bank account

Meet Our Management Team

MICHAEL GUTHRIE

Michael Guthrie has raised over $88 million in capital and built a business empire that includes 8,800+ ATMs. As an experienced real estate investor and capital deployment expert, Michael specializes in helping accredited investors find stable, income-producing opportunities that deliver consistent returns while reducing portfolio risk.

Robin Seib

Robin Seib has closed over 350 land deals without ever leaving his office, making him one of the most experienced remote land investors in the industry. Robin has mastered the art of identifying, acquiring, and monetizing raw U.S. land opportunities, creating predictable passive income streams for himself and his investment partners.